2023 Gemini Earn SEC Lawsuit: Winklevoss Brothers Face $900M Crypto Lending Crisis

In 2023, the SEC sued Gemini and Genesis over unregistered securities tied to the Gemini Earn crypto lending program, igniting a major dispute involving $900 million in frozen customer funds.

The U.S. Securities and Exchange Commission (SEC) has filed a lawsuit against crypto firms Gemini and Genesis Global Capital for allegedly offering unregistered securities through the Gemini Earn lending program. This legal action comes shortly after Gemini abruptly ended its popular Earn product amid a heated conflict with Genesis.

SEC Labels Gemini Earn Lending Product as Unregistered Security

In February 2021, Gemini partnered with Genesis to launch the Earn program, promising customers returns up to 8% by lending their crypto assets. Genesis would lend out these assets and share profits with Gemini after deducting fees sometimes exceeding 4%, according to court filings in Manhattan. The SEC argues that Genesis failed to register the Earn product as a security, violating federal laws.

SEC Chair Gary Gensler emphasized, “These charges reinforce that crypto lending platforms and intermediaries must comply with established securities regulations to protect investors and maintain market integrity.”

Gemini Ends Earn Amid $900 Million Customer Fund Dispute

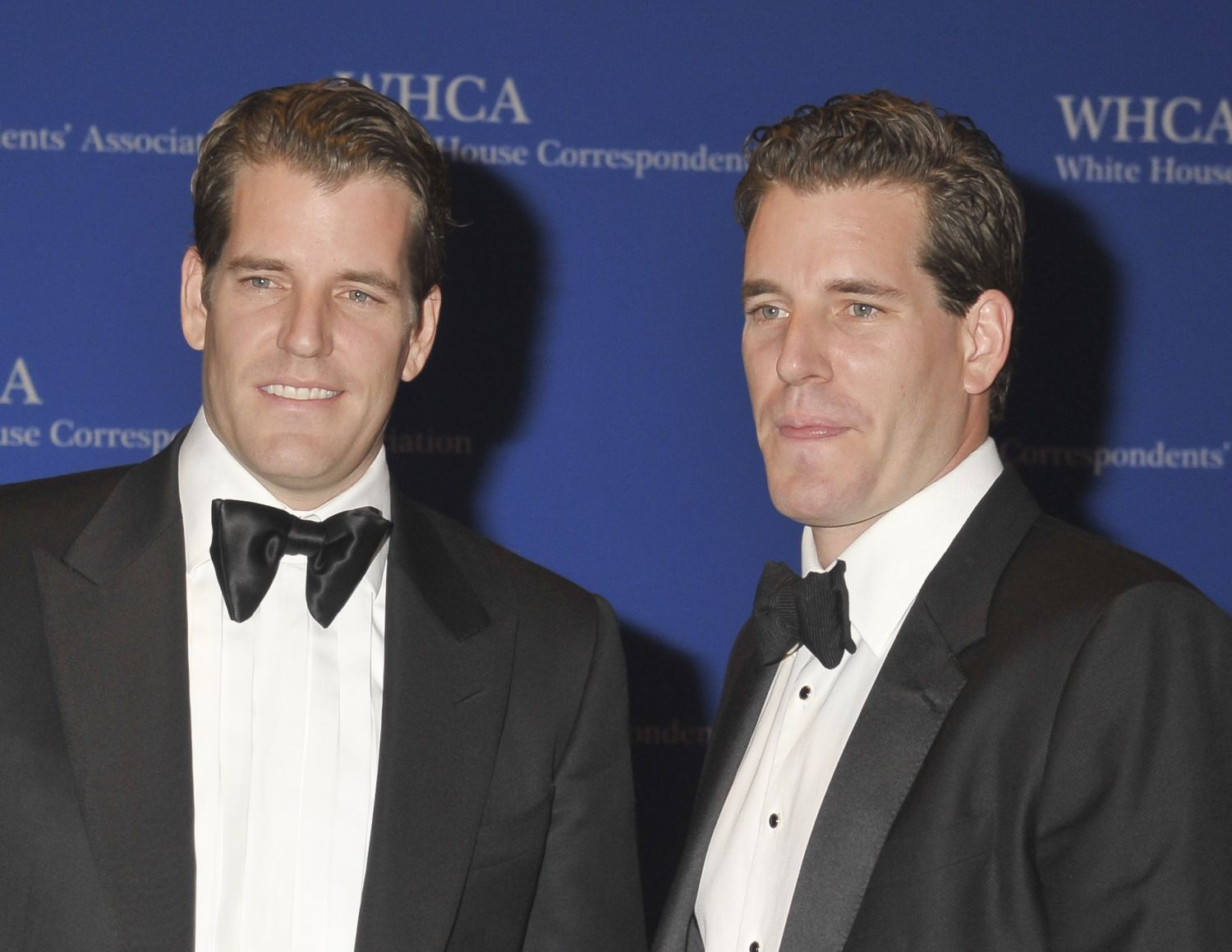

Founded by the Winklevoss twins, Gemini is embroiled in a dispute with Genesis, owned by Digital Currency Group, over $900 million in customer funds frozen following the FTX collapse in late 2022. After FTX's bankruptcy, Genesis halted new loans and withdrawals as $175 million of its assets were trapped on the failed exchange.

Gemini subsequently warned customers of withdrawal delays for the Earn program. The ongoing financial strain has pushed Genesis toward potential bankruptcy after failing to raise $1 billion, prompting Gemini to terminate Earn on January 11, 2023, citing concerns over Genesis’s transparency with more than 340,000 clients.

Implications and Industry Impact

This SEC lawsuit marks another significant regulatory crackdown on crypto lending products classified as unregistered securities. Previously, BlockFi’s subsidiary settled for $100 million in 2022 over similar SEC charges.

The legal battle leaves Gemini facing severe financial challenges, given Genesis’s $900 million debt with little prospect of repayment. Tyler Winklevoss expressed disappointment over the SEC’s timing, calling the lawsuit “totally counterproductive” as Gemini strives to reimburse its vast customer base.

Explore useful articles in Cryptocurrency News as of 18-01-2023. The article titled " 2023 Gemini Earn SEC Lawsuit: Winklevoss Brothers Face $900M Crypto Lending Crisis " offers in-depth analysis and practical advice in the Cryptocurrency News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " 2023 Gemini Earn SEC Lawsuit: Winklevoss Brothers Face $900M Crypto Lending Crisis " article expands your knowledge in Cryptocurrency News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.