Maximize Your 2025 Tax Refund: Best Savings and CD Rates to Grow Your Money

Discover how to make the most of your 2025 tax refund by investing in high-yield savings accounts and top-paying CDs. Learn about current rates, benefits, and strategies to boost your refund with minimal risk.

Summary of Key Points

- 2024 offers historically high interest rates, making it ideal to deposit your tax refund into high-yield savings accounts or competitive CDs.

- Leading savings accounts currently yield between 5.00% and 5.50% APY with flexible withdrawal options.

- Locking your refund into a CD can secure a higher fixed interest rate for a set term, enhancing your overall returns.

- Choosing a CD encourages disciplined saving by limiting early withdrawals through penalties.

- Interest rates on savings and CDs are expected to decline later in 2024, so acting promptly can maximize your earnings.

Grow Your 2024 Tax Refund with High-Yield Savings Accounts

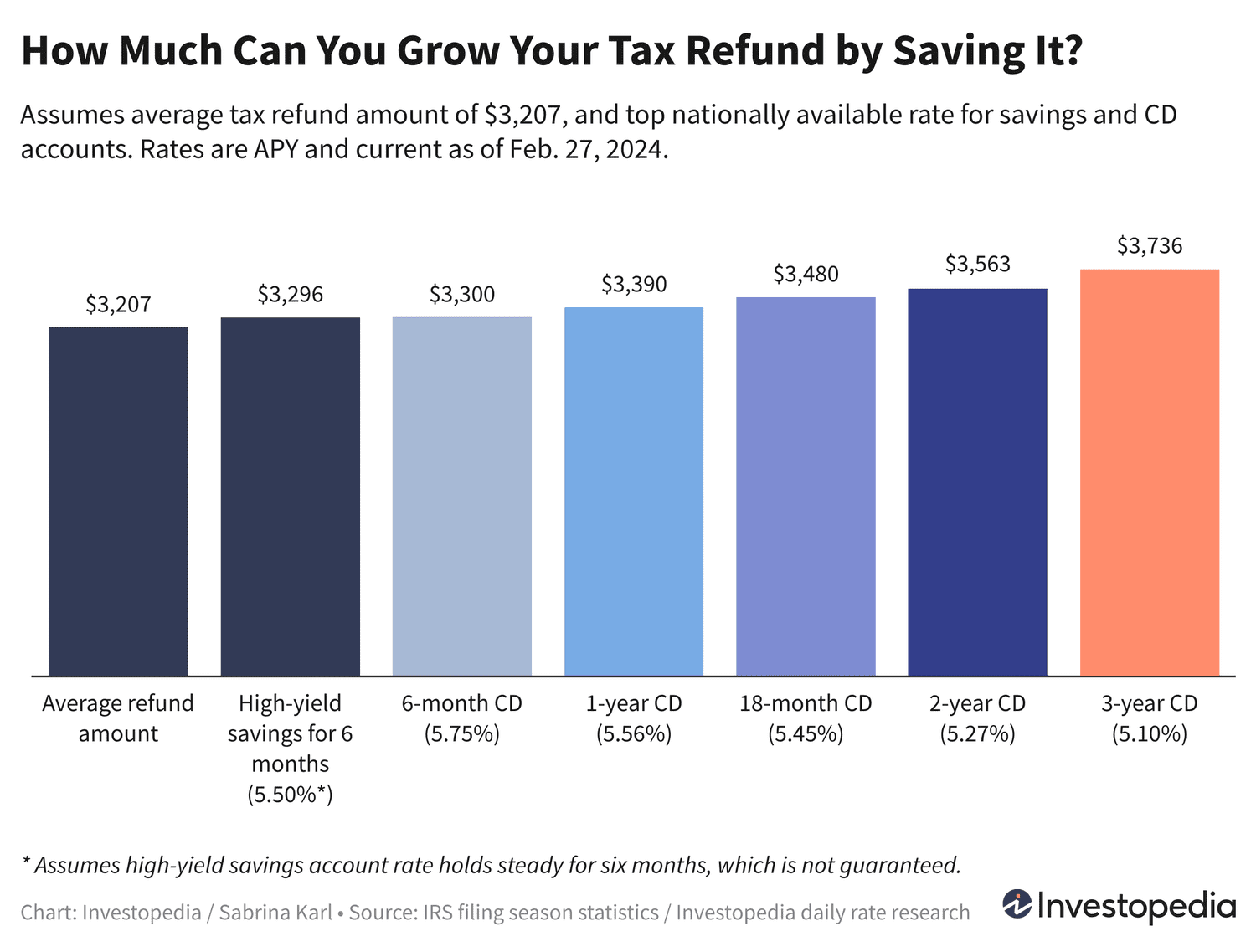

With the IRS already processing millions of tax refunds averaging around $3,200, you have a valuable opportunity to grow your funds. If immediate access to your refund isn’t necessary, placing it in a high-yield savings account can generate substantial interest thanks to current market conditions.

Top savings accounts currently offer up to 5.50% APY, with many options exceeding 5.00%. These accounts provide the flexibility to withdraw funds anytime without penalties, making them a practical choice for accessible growth.

For example, a $3,207 refund invested at 5.50% APY could grow significantly over 6, 9, or 12 months, compounding your refund effectively.

Note:

While savings account rates are variable and can fluctuate, the current rates are historically favorable. However, there’s no guarantee how long these rates will remain elevated.

Boost Returns Further with Top-Paying Certificates of Deposit (CDs)

If you can set aside your refund without needing immediate access, CDs provide a guaranteed fixed interest rate for terms ranging from months to years. This stability can result in higher earnings compared to variable-rate savings accounts.

CDs typically offer superior rates for 6-month and 1-year terms, and longer-term CDs lock in rates to protect you from future declines. Keep in mind that early withdrawals usually incur penalties, so it’s important to choose a term length that fits your financial plans.

Investing your refund in a CD not only enhances your returns but also encourages saving discipline by deterring impulsive spending.

Important:

Although early withdrawal penalties apply, this feature helps maintain your savings intact, maximizing growth potential.

2024 Outlook: What to Expect for Savings and CD Rates

Interest rates on savings accounts and CDs are at their highest levels in over two decades, driven by the Federal Reserve’s rate hikes aimed at controlling inflation. While savings accounts maintain peak rates near 5.50% APY, CD rates have slightly softened but remain historically strong, often ranging between 4% and 5%.

Experts anticipate the Federal Reserve will start cutting rates during mid to late 2024, likely causing savings and CD rates to decline. Market projections suggest the first rate reduction could occur around June or July, although this depends on ongoing economic data.

Given this expected downward trend, securing your tax refund in a high-yield account or CD now ensures you benefit from the current favorable rates before they drop.

Current Top Rates for May 2025 Maturities

- Best CD Rates: Up to 4.50% APY

- Best High-Yield Savings Accounts: Two offers at 5.00% APY

- Best Money Market Accounts: Up to 4.40% APY

How We Identify the Best Savings and CD Rates

Our team analyzes daily rate data from over 200 federally insured banks and credit unions nationwide. To qualify, institutions must have FDIC or NCUA insurance and offer accounts with minimum deposits not exceeding $25,000. Banks must operate in at least 40 states, and credit unions with high donation requirements are excluded to ensure accessibility.

We update our rankings regularly to help you find the most competitive and reliable options to maximize your savings and CD returns.

Discover engaging topics and analytical content in Personal Finance News as of 03-03-2024. The article titled " Maximize Your 2025 Tax Refund: Best Savings and CD Rates to Grow Your Money " provides new insights and practical guidance in the Personal Finance News field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " Maximize Your 2025 Tax Refund: Best Savings and CD Rates to Grow Your Money " helps you make smarter decisions within the Personal Finance News category. All topics on our website are unique and offer valuable content for our audience.