Smishing Scams: How fraudulent texts fund luxury lifestyles and the crackdown to stop them

An in-depth look at smishing, the text-based fraud that steals data and funds lavish crime sprees, and how UK authorities are tightening controls to protect consumers.

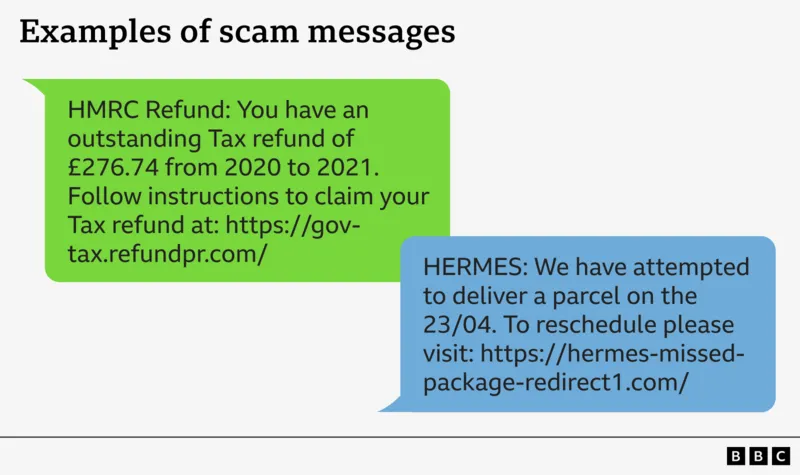

Smishing, a portmanteau of SMS and phishing, is a growing form of fraud that uses text messages to coax people into revealing passwords, PINs, or banking details. The tactic is highly scalable and often hard to trace, making it a favorite tool for criminals.

In a London evidence room, investigators lay out rows of designer goods seized from fraudsters, a stark reminder of the cash flow behind these crimes. From Gucci stilettos to luxury handbags, the items illustrate how fraudsters spend the proceeds of their scams on high-end lifestyle perks.

Detectives estimate tens of thousands of messages can be sent in a short window, turning smishing into a high-volume, low-cost crime. One case saw a defendant sending about 15,000 texts in five days, generating around £100,000 in monthly earnings through fraud.

Among the victims is Gideon Rabinowitz, a 64-year-old IT professional from Berkshire who lost more than £1,000 after receiving a fraudulent text. He describes feeling shocked and vulnerable after realizing a bank-like message was a scam, not a legitimate alert.

The criminals use two main tools: a SIM farm, which holds numerous SIM cards to blast out thousands of messages, and an SMS blaster, a device that triggers a rapid flood of texts to nearby phones. Together, these tools scale the reach of smishing far beyond what one operator could achieve alone.

Officials emphasize that many smishing messages mimic familiar brands, such as banks, utilities, or couriers, urging recipients to click a link or share sensitive data. After a user visits a fraudulent site, fraudsters may request personal information or prompt transfers from bank accounts.

To tackle this threat, the Dedicated Card and Payment Crime Unit, a collaboration between City of London Police and the Metropolitan Police, operates with national reach and industry support from the banking sector. Its mission is to disrupt financial fraud and safeguard consumers.

Policy makers have described smishing as having a devastating impact on victims and announced a crackdown on SIM farms. A government plan to ban the possession or supply of SIM farms, unless a valid reason is shown, is slated to take effect late next year to curb these operations.

Experts acknowledge smishing is difficult to police, especially when operations originate abroad or use quickly changing networks. As former cyber security leadership notes, the real solution lies in public awareness and stronger business verification processes, rather than relying on policing alone.

Public guidance from authorities remains simple: do not click on links in unsolicited texts, and verify any suspicious alert directly with your bank or service provider. If you suspect fraud, report it to Action Fraud, contact your bank, and forward the message to 7726 so telecom networks can investigate.

Additional reporting by Kris Bramwell. For more resources, visit INLIBER.co.uk/scamsafe and INLIBER.co.uk/actionline for help if you have been targeted by fraud.

Key Takeaways

- Smishing uses fake texts to steal personal and financial information.

- Criminals fund lavish lifestyles with proceeds from these scams, sometimes via large-scale messaging operations.

- Authorities are tightening controls, including plans to ban SIM farms to curb mass messaging tactics.

- victims should avoid clicking links and report suspected fraud promptly.

- Public awareness and collaboration with banks are crucial to reducing smishing impact.

Expert Perspective

Expert comment: Smishing is notoriously hard to police when much of the activity crosses borders. The key defense is education and robust verification by businesses so customers know not to trust texts at face value.

Summary

Smishing fraud continues to evolve, turning unsuspecting mobile users into targets and funding luxury showpieces for criminals. While law enforcement ramps up takedowns and new restrictions, the most effective defense remains cautious scrutiny of messages and verification with trusted sources. Public awareness, rapid reporting, and industry collaboration are essential to reduce harm and deter perpetrators.

Smishing thrives where trust meets speed. The best defense is skepticism and verification, backed by strong industry and law enforcement collaboration. BBC News