30-Year Mortgage Rates Retreat to the 6% Range

Explore the latest trends as 30-year mortgage rates dip below 7%, marking a significant shift in the housing finance landscape. Discover how this impacts various loan types and what it means for homebuyers and refinancers in 2025.

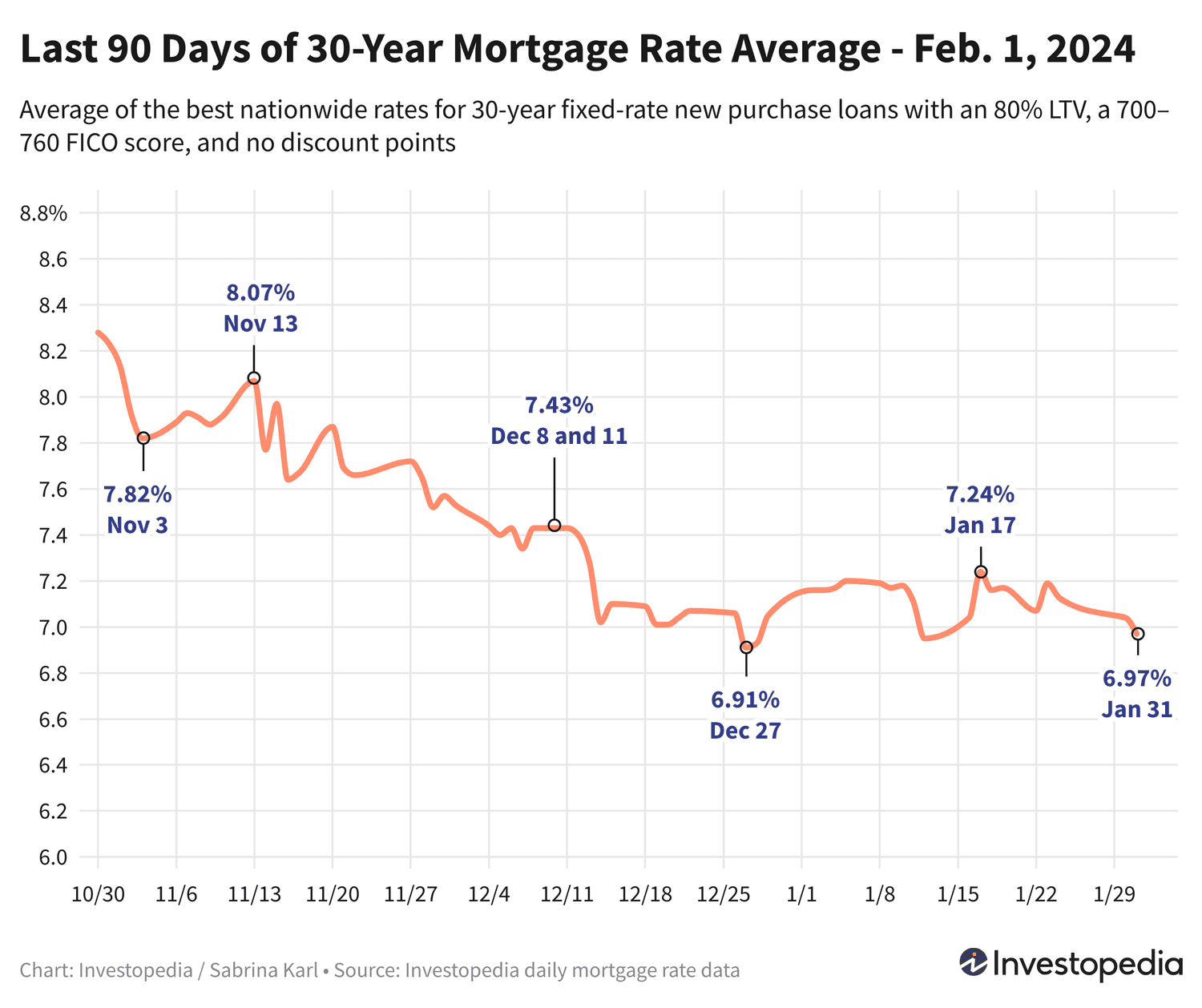

Mortgage Rate Update - February 1, 2024

For over a week, 30-year mortgage rates have consistently declined, with Wednesday's figures dropping the average rate to 6.97%. This marks only the second occasion this year that rates have fallen below the 7% threshold. Alongside this, most other mortgage loan categories also experienced notable decreases on the same day.

Given the variability of mortgage rates across different lenders, it's highly advisable to compare options regularly to secure the most favorable terms, regardless of the loan type you pursue.

Current Mortgage Rate Averages for New Home Purchases

On Wednesday, 30-year fixed-rate mortgages for new purchases dropped by 7 basis points, culminating in a 22-point decline over the past six trading days. This return to the 6% range is significant, with the 6.97% average being only the fourth instance since May 2023. Previously, similar rates were recorded in mid-January and late December. These figures remain well below the historic 23-year peak of 8.45% observed in October.

Looking ahead, compare today's mortgage rates to find the best fit for your needs - updated as of May 9, 2025.

15-year new purchase mortgage rates saw an even steeper decline on Wednesday, dropping 11 basis points to an average of 6.30%. Although this remains slightly above the seven-month low of 6.10% reached in late December, it is a marked improvement from the 7.59% peak seen in October, the highest level since 2000.

After nine consecutive days of stability, jumbo 30-year mortgage rates finally fell, decreasing by 12 basis points to 6.45%, marking a two-week low. While daily historical jumbo mortgage data prior to 2009 is unavailable, the October peak of 7.52% is estimated to be the highest in over two decades.

Most other mortgage averages declined moderately on Wednesday, with 20-year new purchase loans experiencing the largest drop of 20 basis points.

Freddie Mac’s Weekly Average

Freddie Mac’s weekly report, published every Thursday, recorded a 30-year mortgage rate average of 6.63% today. This reflects a significant drop from the late October peak of 7.79%, the highest in 23 years. Over the past three months, Freddie Mac’s average has fallen by more than a full percentage point.

It's important to note that Freddie Mac calculates a weekly average based on five prior days, whereas Investopedia provides daily averages for more immediate insights. Additionally, Freddie Mac’s figures may include loans with discount points, unlike Investopedia’s zero-point loan averages.

Refinancing Rate Trends

Refinancing rates mirrored new purchase trends on Wednesday, with the 30-year refinance average decreasing by 8 basis points. Currently, there's a 58 basis point difference between 30-year new purchase and refinance rates. The 15-year refinance average dropped by 16 basis points, and the jumbo 30-year refinance average declined by 13 points.

The most significant refinance rate change was seen in VA 30-year loans, which fell by 19 basis points. All refinance averages declined except for jumbo 15-year and jumbo 7/6 ARM loans, which remained unchanged.

Use our Mortgage Calculator to estimate monthly payments across various loan scenarios.

Important Considerations

The mortgage rates presented here are averages and typically differ from promotional teaser rates advertised online, which often highlight the most attractive offers. Teaser rates may require upfront points or be based on ideal borrower profiles with excellent credit and smaller loan amounts. Your actual mortgage rate will depend on personal factors such as credit score and income, potentially resulting in rates higher or lower than these averages.

State-by-State Lowest Mortgage Rates

Mortgage rates vary by state due to differences in credit profiles, loan types, and lender risk strategies. The most affordable 30-year new purchase rates are currently found in Mississippi, Iowa, Louisiana, and Vermont. Conversely, Minnesota, Oregon, Arizona, Nevada, and Washington report the highest rates.

Factors Influencing Mortgage Rate Fluctuations

Mortgage rates are shaped by a dynamic mix of macroeconomic and industry-specific factors, including:

- Movements in the bond market, particularly 10-year Treasury yields

- The Federal Reserve's monetary policies, especially regarding bond purchases and government-backed mortgage funding

- Competitive dynamics among mortgage lenders and across different loan products

These elements often interact simultaneously, making it challenging to pinpoint a single cause for rate changes.

In 2021, mortgage rates remained relatively low, influenced by the Federal Reserve's extensive bond-buying program aimed at mitigating pandemic-related economic impacts. This policy significantly affects mortgage rates.

Starting November 2021, the Fed began tapering bond purchases, culminating in a complete halt by March 2022. Subsequently, the Fed aggressively raised the federal funds rate through mid-2023 to combat inflation. While this rate influences mortgage rates indirectly, their movements can occasionally diverge.

The rapid and substantial rate hikes—totaling 5.25 percentage points over 16 months—have contributed to the recent mortgage rate increases.

At its latest meetings, the Fed has paused rate hikes but signaled caution regarding future rate cuts, with no reductions expected before the March 19-20 meeting. Most Fed members anticipate two to four rate cuts in 2024, but the timing and extent remain uncertain.

Our Mortgage Rate Tracking Methodology

The national averages presented are derived from the lowest rates offered by over 200 leading lenders nationwide, assuming an 80% loan-to-value ratio and a FICO score between 700 and 760. These averages reflect realistic quotes borrowers might receive, distinct from promotional teaser rates.

For state-specific lowest rates, the data reflects the best available lender offer in each state under the same parameters.

Explore useful articles in Personal Finance News as of 06-02-2024. The article titled " 30-Year Mortgage Rates Retreat to the 6% Range " offers in-depth analysis and practical advice in the Personal Finance News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " 30-Year Mortgage Rates Retreat to the 6% Range " article expands your knowledge in Personal Finance News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.